A Vital Investment in Our Schools

Renewing the 1% Earned Income Tax Levy keeps our schools strong without raising taxes.

What is the NELSD Levy?

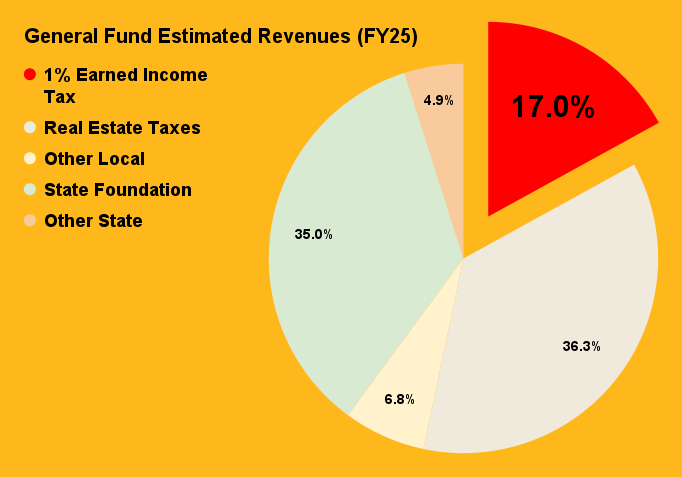

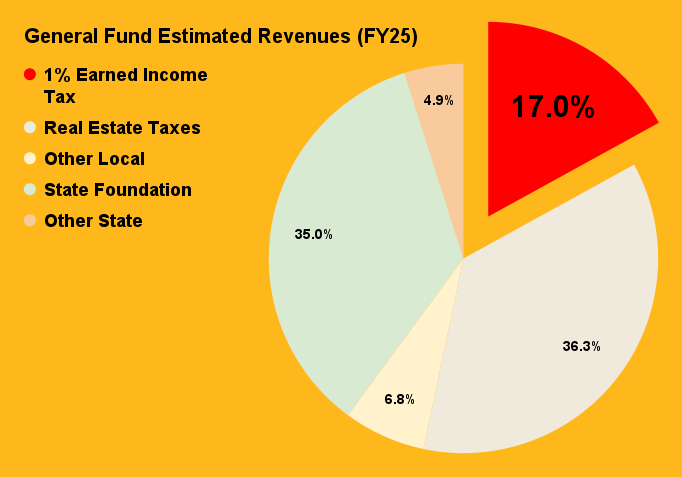

The Northeastern Local School District (NELSD) 1% Earned Income Tax Levy is a renewal levy for 10 years that provides 17% of the district’s operational budget (about $6 million)—funding essential programs, salaries, student services, and day-to-day school operations.

This levy is not a new tax; it is a continuation of an existing funding source that has been supporting our schools since 2015.

Why is Renewal Critical?

The levy ensures that our district can continue to provide high-quality education and essential services without disruptions. Losing this funding would have a direct and significant impact on students, teachers, and the entire school community.

Without these funds, NELSD may face: ✔️ Staff reductions, increasing class sizes

✔️ Cuts to programs like music, arts, and extracurricular activities

✔️ Decreased technology & learning resources

✔️ Reductions in transportation

Where Does the Money Go?

01

🎓 Salaries & Staff

Maintains teacher & staff salaries for quality education.

02

🏫 Student Programs

Supports arts, music, and extracurricular activities.

03

💻 Technology

Funds classroom technology & modern learning tools.

04

🚌 Transportation

Maintains buses & ensures student safety.

05

🔧 Facilities & Supplies

Covers maintenance, utilities, and daily operations.

06

📖 Special Education & Support Services

Provides resources for students with special needs and additional academic support.

How NELSD is Funded & Why the Levy Matters

NELSD relies on a combination of local, state, and federal funding to operate, but local revenue plays the largest role in keeping our schools running. The 1% Earned Income Tax Levy alone accounts for 17% of the district’s budget (about $6 million), making it a vital funding source for daily operations, salaries, and student programs.

State funding has increased only 4.3% over the last 10 years since this levy first passed. The new 2-year state budget proposal, if passed, will cut NELSD state funding by about $1 million. Local contributions—like this levy—are what keep our schools competitive and well-equipped. NELSD is already operating efficiently, ranking 2nd lowest in cost per student among Clark County schools, but losing this levy would create a major financial shortfall that state funds cannot replace.

50%

of NELSD’s operations are funded by local revenue.

4.3%

is the total increase in state funding over the past 10 years.

17%

of the district’s budget will be lost if the levy is not renewed.

2nd lowest

operating cost per student in Clark County, proving fiscal responsibility.

What Happens If the Levy Fails?

Without this levy, NELSD faces a 17% budget shortfall, forcing difficult financial decisions affecting students and families which could include the following:

❌ Decreased funding for transportation & technology

❌ Larger class sizes due to teacher/staff reductions

❌ Cutbacks on extracurricular activities & student programs

❌ Decreased funding for updates to curriculum

❌ Prevent planning to address increasing student enrollment

How Can You Help?

✔️ Vote on May 6, 2025 or through Early Voting (starts April 8th)

✔️ Spread the word—talk to neighbors, friends, and family

✔️ Volunteer with the Northeastern District Levy Committee

✔️ Request a yard sign to show your support

District Financial Information

Understanding the Financial Impact of the Levy

Ensuring transparency in school district finances is essential to building trust within our community. Below are key financial resources from the Northeastern Local School District (NELSD) that provide detailed insights into funding, budgeting, and the levy’s impact on school operations.

🔗 Levy Information Page

This page provides official district details about the levy renewal, including why it is necessary, what it funds, and its impact on school programs.

🔗 Treasurer’s Page

The NELSD Treasurer’s Office oversees the district’s budget, financial planning, and reporting. This page provides access to annual budgets, financial forecasts, and general funding information.

🔗 School Finance 101 Presentation

A simple breakdown of how school funding works, what sources contribute to district revenue, and why levies like this one are essential. A great resource for understanding public school finances.

🔗 2025 Monthly Financial Reports

Stay informed with monthly updates on the district’s finances, including revenue, expenditures, and budgeting progress.